had built a horrible one,” quipped AMD executive Frank Azor. “So the demand has been a little higher than we forecasted.”

It’s no secret that Intel’s Arrow Lake delivered underwhelming gaming performance at launch. Although the company has promised a ‘fix’ for the issue, we recently tested the full and complete patch on multiple systems. We found the patch does nothing to help (at least on two motherboards) and that the newer Windows revision required for the fix has benefited competing processors more, thus making Intel’s Arrow Lake position even worse than at launch. We’ll publish that testing soon.

All of this means that Intel is far less competitive than AMD anticipated.

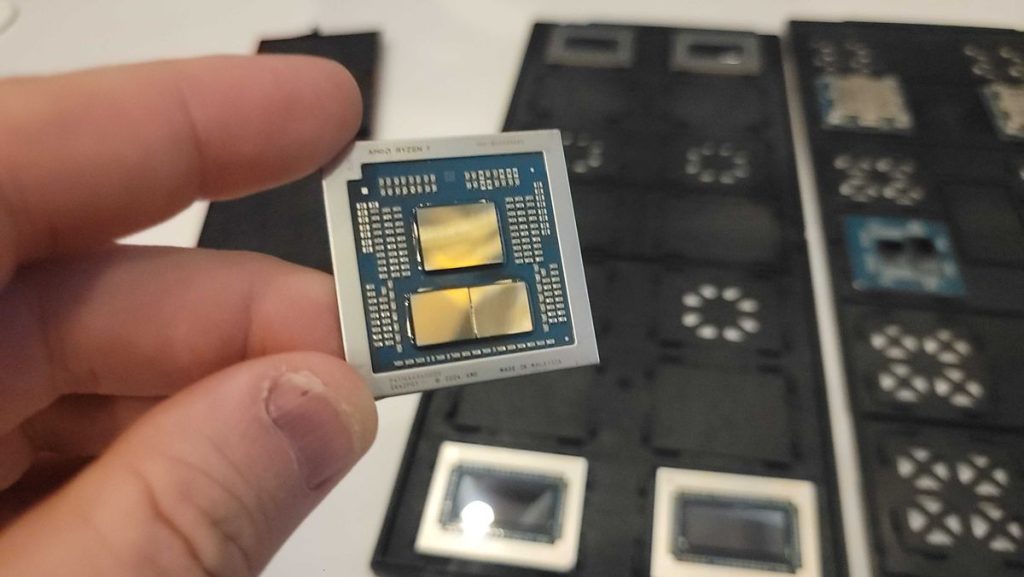

That’s exacerbated by the longer-than-normal lead time for building an X3D processor. Due to the long lead times associated with building modern high-end processors, forecasting demand is key. Now that demand has far outstripped the original production targets, the company is cranking higher production into gear— but that takes time to filter down to the retail market.

“We have been ramping our manufacturing capacity, or the monthly, quarterly output of X3D parts, period, and that’s 7000 [series] as well as 9000X3D,” said AMD executive David McAfee. “It’s crazy how much we have increased over what we were planning. I would say the demand we’ve seen for the 9800X3D and the 7800X3D has been unprecedented. So the demand has been higher than ever.”

“Building a traditional semiconductor, it’s basically 12 to 13 weeks from when you start a wafer to when you get a product out the other end of the machine,” McAfee explained. “The stacking process adds time to that, and so it’s longer than a quarter horizon (three months) to really ramp output of those products. And so we’re working very, very hard to catch up with demand. I think as we go through the first half of this year, you’ll see us continue to increase the output of X3D. There’s no secret, X3D has become a far more important part of our CPU portfolio than I think any of us would have predicted a year ago. And I think that trend will continue in the future, and we are ramping capacity to ensure we catch up with that demand for as long as customers want those X3D parts.”

McAfee said there isn’t any particular component or part of the production flow creating the bottleneck.

“It’s the problem that you’ve got that lead time to build individually the CCD wafer, the cache wafer, and then the stacking process that follows that, which also adds a considerable amount of time. It’s a non-trivial timeline when you’re talking about building X3D products.”

McAfee also said new X3D products won’t help spread the demand, as customers choose the 8-core X3D parts 10-to-1 over the higher core count X3D models.

“If I look historically at our 7000X3D products, the 70800X3D was dramatically the highest volume part in that product stack. I think that for those 12 and 16 core parts, there are certain types of customers that buy those. But I think the reality is if you are truly a creator, you probably still buy the 9950X. The X3D doesn’t add much at all for creator workloads. I think of the data we’ve seen, and you guys will see it as well when you get the chance to review it. It’s like a percentage of incremental performance by having the X3D there.” McAfee said.

“My belief is, in the 9000 series, those higher core count products, there’ll be some demand there, but it’ll still be 10 to 1 or more on the eight-core X3D parts because they’re just such a great gaming part for a pure gamer, there’s nothing else like it,” he finished.

So now it’s a waiting game. AMD has ramped production, but it will take some time for the flood of shiny new 9800X3D chips to come to market. By the time more units arrive, we’ll likely see the new 9950X3D and 9900X3D landing on shelves as well.

As for Intel, it has been incapable of answering AMD’s 3D V-Cache technology — and for an extended period of time. I spoke with the company about its plans at a separate roundtable.

“AMD has been executing with its stacked 3D V-Cache X3D processors for three generations now. They’re integrating it into more and more products, bringing it to mobile, etc., and we expect that trend to continue,” I said. “Intel has really not responded to that at all, at least in any way that we can see from the outside looking in. That’s effectively ceding that high-margin, premium-tier gaming segment to AMD wherever they choose to deploy that technology. What are you guys considering as a response to this?” I asked.

“Our goal is that leadership product in every segment, and I’m not going to talk about unannounced products,” replied Intel’s Jim Johnson, Corporate VP and GM of Client Engineering.

With no official response from Intel on the matter and no indications through leaks or other industry chatter that Intel has a new competing tech in the works, AMD will likely continue to dominate the global gaming market. For now, it is AMD’s gaming world, and Intel is just living in it.